Life Insurance in and around Metairie

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Chalmette

- Arabi

- Jefferson

- Kenner

- New Orleans

- Slidell

- Laplace

- St Bernard

- Mandeville

- Covington

Your Life Insurance Search Is Over

No one likes to entertain ideas about death. But taking the time now to arrange a life insurance policy with State Farm is a way to demonstrate love to your family if death comes.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

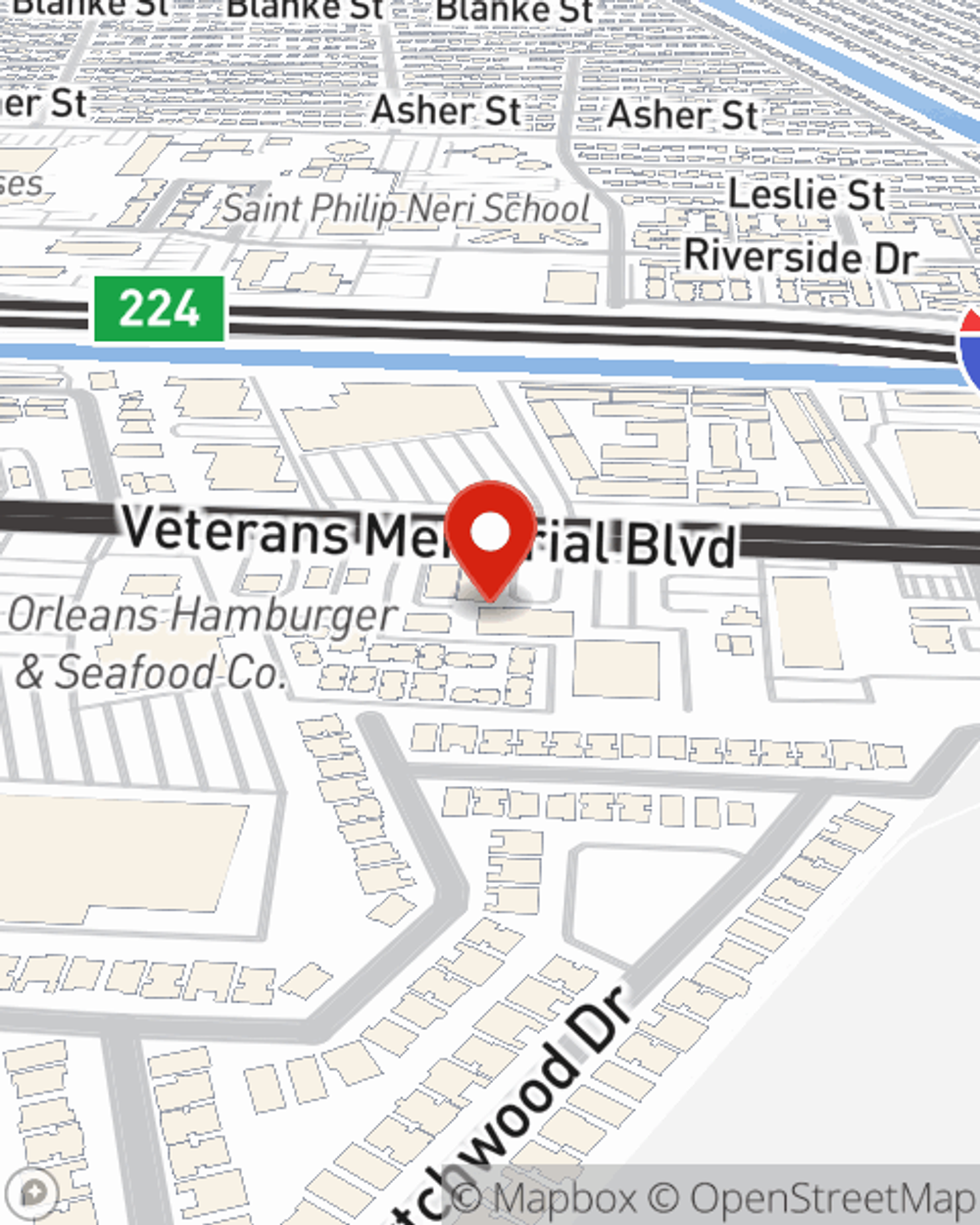

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Kert LeBlanc. Kert LeBlanc is the compassionate associate you need to consider all your life insurance needs. So if death comes, the beneficiary you designate in your policy will help your loved ones or the ones you hold dear with matters such as your funeral costs, phone bills and home repair costs. And you can rest easy knowing that Kert LeBlanc can help you submit your claim so the death benefit is presented quickly and properly.

If you're looking for dependable insurance and caring service, you're in the right place. Reach out to State Farm agent Kert LeBlanc today to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Kert at (504) 454-6036 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Kert LeBlanc

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.